Drag for more

Program Experience

Highlights and Key Outcomes

In Investment Strategies and Portfolio Management, you will:

- Receive new tools and techniques for creating profitable investment portfolios

- Critically evaluate investment managers using the latest research

- Gain a deeper understanding of how to account for financial risk, including the impact of unforeseen small-probability events like pandemics

- Learn how to assess the stock market’s reactions to events using behavioral finance principles

- Get an expert view of the predicted length and shape of an economic recovery

- Understand the macroeconomic outlook both in the U.S. and globally

Experience & Impact

Investment Strategies and Portfolio Management provides financial professionals with a powerful new strategic approach based on the latest Wharton research. In this program, Wharton faculty, who are world-class thought leaders in the world of finance, will explore a wide variety of investing topics — from enhanced portfolio theory to bond management, from hedge funds to private equity.

Participants will acquire the latest tools and techniques for designing optimal investment portfolios that serve people’s needs. You will also learn to effectively evaluate investment management options using newly available research data. Find out how investment managers are currently rated, what variables are used to assess their skills, and how to weigh these factors against the fees they charge. This is essential knowledge both for investors and for investment management firms looking to hire managers.

Risk management is a key topic in this program, including an analysis of small-probability, disaster-type events such as the global pandemic. Wharton professors will delve into why the standard measure of risk, often called volatility, is insufficient. They will discuss what is known as tail risk — extremely bad, infrequent occurrences — and describe how investment professionals can pick up early indicators and better manage such events.

Balancing the historical with the visionary — yet practical above all — this program enables you to access the best minds in finance so you can steer with confidence through this unique time.

Session topics include:

- The Asset Menu

- Enhanced Portfolio Theory

- Performance Measurement vs. Skill

- Evaluating and Rating Managers: Case

- Behavioral Finance

- Bond Management

- Stock Markets vs. Bond Markets: Case

- Advanced Asset Allocation

- Risk Management

- Private Equity

- International Markets

- Macroeconomic Outlook

- Hedge Funds

- Real Estate

Convince Your Supervisor

Here’s a justification letter you can edit and send to your supervisor to help you make the case for attending this Wharton program.

Due to our application review period, applications submitted after 12:00 p.m. ET on Friday for programs beginning the following Monday may not be processed in time to grant admission. Applicants will be contacted by a member of our Client Relations Team to discuss options for future programs and dates.

Who Should Attend

Investment Strategies and Portfolio Management provides invaluable insights to different types of finance professionals and investment services providers. Specifically, this program is ideal for:

- Chief investment officers, asset managers, and investment analysts

- Portfolio managers for pension funds, sovereign wealth funds, institutional investors

- Family office representatives and other private wealth advisors to ultra-high-net-worth individuals and families

- High-net-worth individuals and others who manage their own investments or wish to become more knowledgeable on how to work with professional money managers

- CPAs, attorneys, and other professionals who advise institutional investors

- Employees of insurance companies

- Commercial bank employees with portfolio management responsibilities

Fluency in English, written and spoken, is required for participation in Wharton Executive Education programs.

Participant Profile

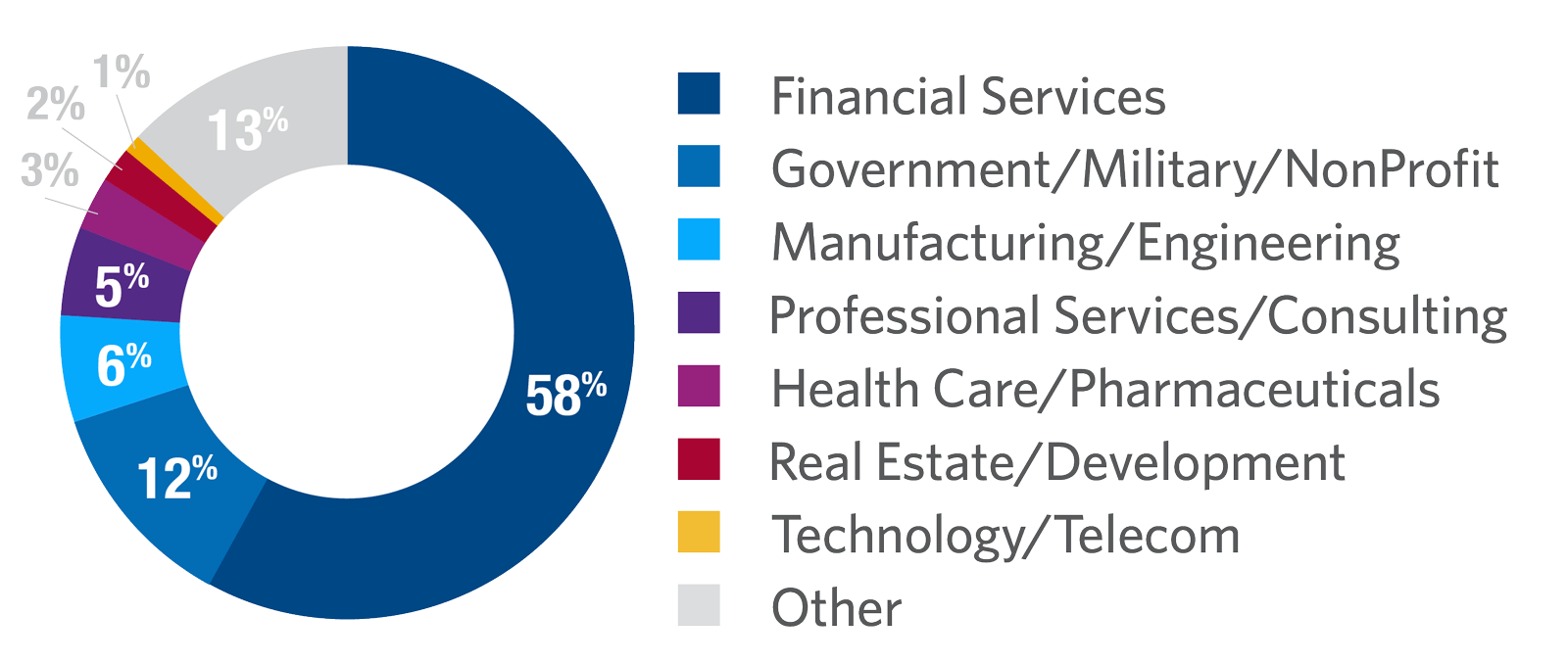

Participants by Industry

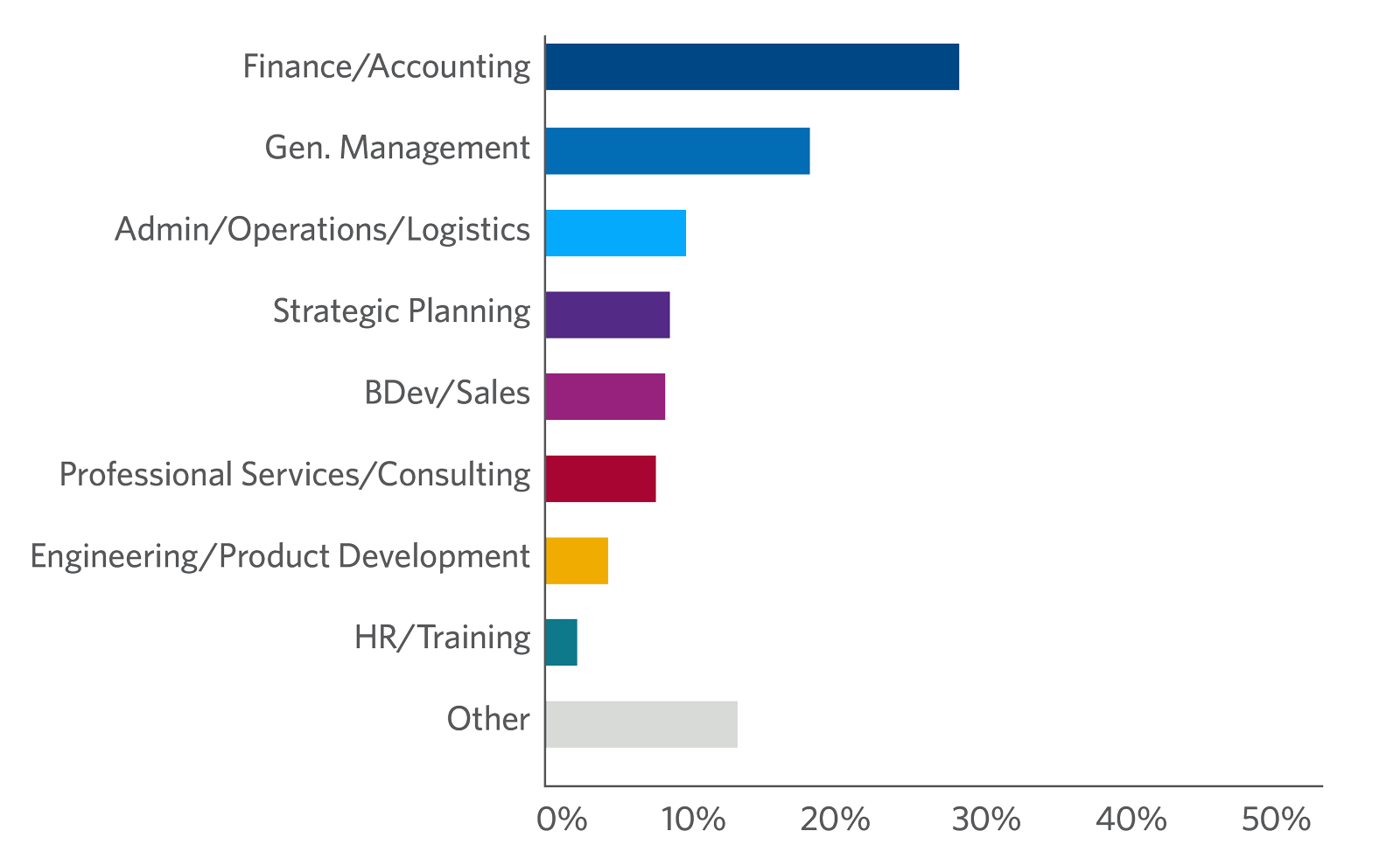

Participants by Job Function

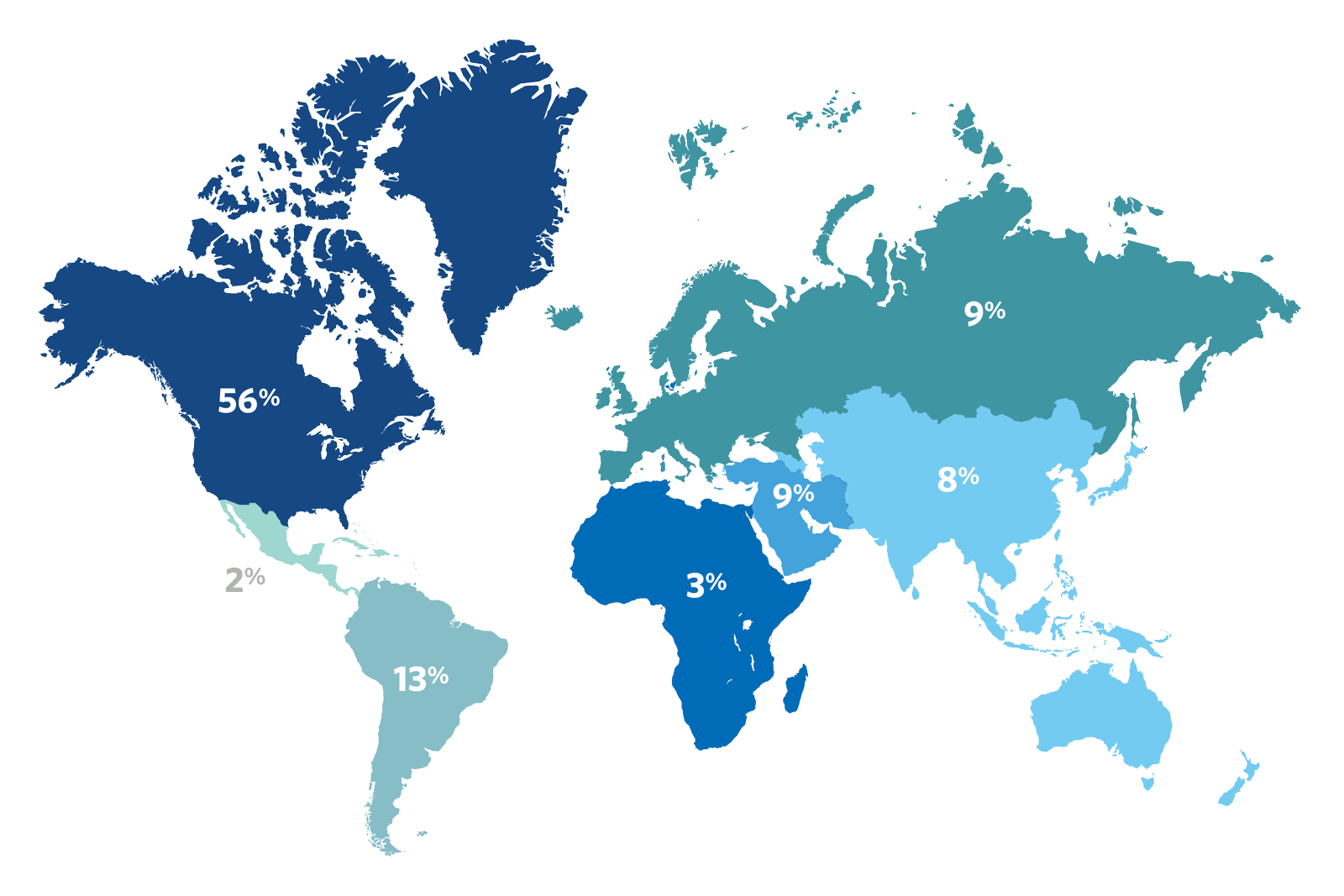

Participants by Region

Plan Your Stay

This program is held at the Steinberg Conference Center located on the University of Pennsylvania campus in Philadelphia. Meals and accommodations are included in the program fees. Learn more about planning your stay at Wharton’s Philadelphia campus.

Group Enrollment

To further leverage the value and impact of this program, we encourage companies to send cross-functional teams of executives to Wharton. We offer group-enrollment benefits to companies sending four or more participants.

Faculty

Jules van Binsbergen, PhDSee Faculty Bio

Academic Director

The Nippon Life Professor in Finance; Professor of Finance, The Wharton School

Research Interests: Asset pricing, institutional investors, investments

Gordon Bodnar, PhDSee Faculty Bio

Director, International Economics Program, School of Advanced International Studies (SAIS), Johns Hopkins University

Research Interests: International finance, corporate finance

Burcu Esmer, PhDSee Faculty Bio

Academic Co-Director, Harris Family Alternative Investments Program; Academic Director, Wharton-AltFinance Institute; Senior Lecturer of Finance

Research Interests: Research Interests: Empirical corporate finance, alternative investments

Christopher Geczy, PhDSee Faculty Bio

Adjunct Professor of Finance; Academic Director, Wharton Wealth Management Initiative; Academic Director, Jacobs Levy Equity Management Center for Quantitative Financial Research, The Wharton School

A. Craig MacKinlay, PhDSee Faculty Bio

Joseph P. Wargrove Professor of Finance, The Wharton School

Research Interests: Asset pricing models, behavior of futures prices, econometric modeling, stock market behavior

Nikolai Roussanov, PhDSee Faculty Bio

Moise Y. Safra Professor of Finance, The Wharton School

Research Interests: Interaction between asset pricing and macroeconomics

Todd Sinai, PhDSee Faculty Bio

David B. Ford Professor; Professor of Real Estate; Professor of Business Economics and Public Policy; Chairperson, Real Estate Department, The Wharton School

Research Interests: Commercial real estate and real estate investment trusts, real estate and public economics, risk and pricing in housing markets, taxation of real estate and capital gains

Testimonials

Christopher Quinley Liang & Quinley Wealth Management

“I recently was named responsible for the asset management area for my bank. I came to Wharton to gain more understanding about asset management and investment strategy. The asset management market in Brazil is huge (more than $1.5 trillion USD) and very sophisticated, but most of the assets are Brazilian-based. However, the demand for international assets has been growing a lot and we need to be able to manage those types of assets. In addition, more global competition is coming to Brazil and we need to differentiate ourselves and understand all kinds of investment strategy that make more sense to our clients.

Wharton’s program has given me a much better understanding of the global market for asset management, even more in this volatile environment. The hedge fund session with Professor Chris Geczy was a major highlight. The tools he gave me for analyzing a hedge fund were very useful. Most of our funds are fixed income and equity. But the markets will change for more complex funds.

Itau Asset Management is one of the biggest asset managers in Brazil (16.5 percent of market share). Today, 90 percent of our portfolio is Brazilian-focused. We are expanding our presence in New York and are preparing to have more international assets in our funds. Wharton gave some great examples on how we can diversify our portfolio to expand our capacity beyond Brazilian assets.”

Fernando Beyruti Managing Director & Co-Head, Itau Asset Management, Brazil

“For me, as a professional asset manager, Wharton’s Investment Strategies and Portfolio Management is definitely a much-needed refresh with a balanced risk and return perspective. The professors share high-level insights, and also engage us with interactive discussions and practical illustration. This helped to elevate my understanding of the new paradigm and gave me focused, time-tested techniques in investment strategies and portfolio management.

After the program, all participants obtained not only the fundamental rationale behind sound asset allocation decisions, but also the advanced technique to manage and evaluate attributed performance on each unique asset class. Now, I am exposed to new ideas that I can apply to foster fund-strategy innovation and improve my fund’s investment performance going forward.”

Johan Sidik Chief Investment Officer, Generali Life Insurance Indonesia